The Risk Intelligence Platform for

Modern MSBs

Protect your business from fraud and automate your compliance

with software built specifically for the Money Service industry

Get to know Lytcheck

Replace legacy broken check cashing software with Lytcheck, the only comprehensive platform to help you manage check cashing, minimize fraud, stay compliant and streamline operations.

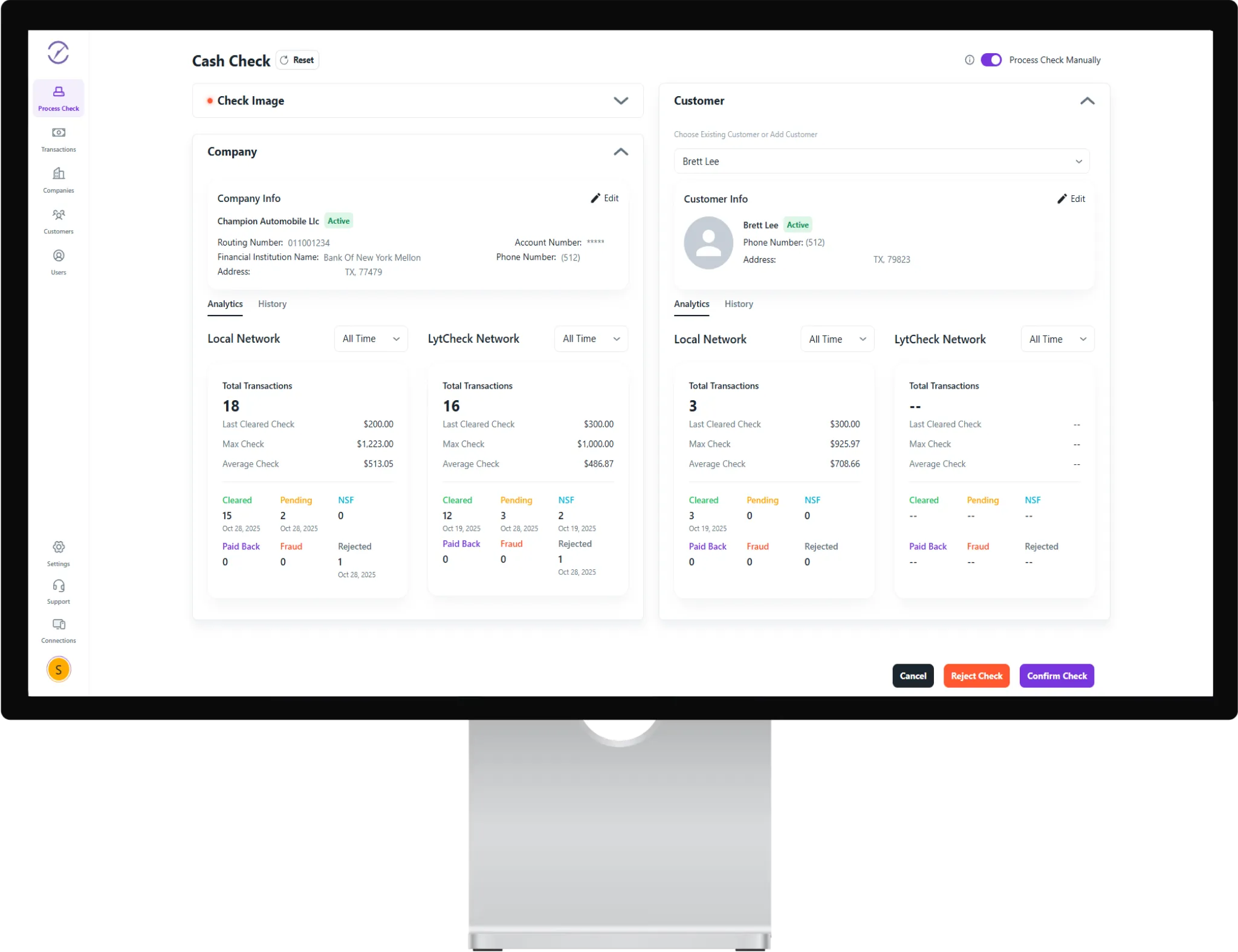

Process checks faster with a modern, AI-assisted workflow

Validate bank accounts instantly, capture data accurately, and automate processing book-keeping entries at the point of transaction.

Proactive Fraud Intelligence

Verify checks and customers with early fraud detection before payout.

Network Analytics Leverage the industry's largest shared intelligence network.

Gain proactive insights and analytics from a high-value network of MSBs sharing proprietary check and customer data to inform your risk decisions and flag known fraudsters.

Regulatory Compliance & Alerts Stay ahead of regulatory thresholds with real-time monitoring.

Instantly flag suspicious activity (like structuring or velocity), generate required CTRs and SARs in just two clicks (coming soon), and access transaction insights immediately

Operations & Security Focus on your business, not your data

Maintain a secure operating environment with scheduled, automated cloud backups, secure data retention, and seamless integration capabilities for all your essential peripherals.

Three ways Lytcheck makes your life easier.

The Future of Check Cashing.

Modern Easy Workflow.

Cash a check in just a few clicks on a single, streamlined screen.

4-Click Workflow

Scan → select company → select customer → confirm

MICR Validation

Verify routing and account numbers instantly

Signature Analysis

Detect alterations by comparing with past images

AI Data Capture

Auto-extract issuer details and addresses

Three Step Check Verification.

Verify checks with a simple, guided three-step process.

Entity Verification

Confirm business legitimacy via registry checks

Phone Verification

Validate issuer and customer phone numbers

Risk Scoring

Early warning scores flag suspicious activity

Duplicate & Velocity

Catch repeat and rapid activity before payout

Lytcheck Network.

Historical insights and analytics give you business intelligence to identify patterns, minimize risk, and optimize operations.

Transaction History

Complete audit trails and records

Risk Reporting

Identify risk patterns and trends

Customer Monitoring

Track customer activity patterns

Custom Dashboards

Tailored business intelligence

Simple, transparent pricing

Choose the plan that fits your business needs. Start saving time and money today.

Essential

$199

/moBusiness & Individual Identity Verification

Bank Account Validation & Authentication

Risk Intelligence & Monitoring

OFAC / SDN Screening

Transaction Audit Trail

Unified Customer & Company Profiles

Automated Cloud Backups

Got questions? We've got answers

Can't find what you're looking for? Contact our support team for personalized help.

What types of businesses benefit most from Lytcheck?

How does Lytcheck help with BSA/AML compliance?

Can Lytcheck work with my check scanner and printer?

How long does it take to get started with Lytcheck?

Does Lytcheck provide regulatory updates?

Don't just take our word for it.

See what locations are saying about Lytcheck

"Lytcheck made check cashing fast and compliant. We scan, verify, and pay out in under a minute. Built-in OFAC, velocity, and duplicate checks already stopped two bad checks last month, and closing is easier with automatic totals and CTR/SAR prep. They also have the best support team in the industry."

Cambio Plus, Kyle, TX

"Our clerks learned Lytcheck in a day. ID capture, check scanner support, fee rules, and customer limits keep us safe while speeding up lines. The real-time dashboard shows payouts, fees, and drawer cash so we close faster with fewer mistakes."

Garfield Market, Houston, TX

"With Lytcheck, fraud and returns went down thanks to blacklist and duplicate detection. Auditors love the one-click reports. Tellers spend less time on forms, and compliance reviews are straightforward. Our scanner and printer worked right away."

Brew Market, Pflugerville, TX

© 2026 LytCheck. All rights reserved.